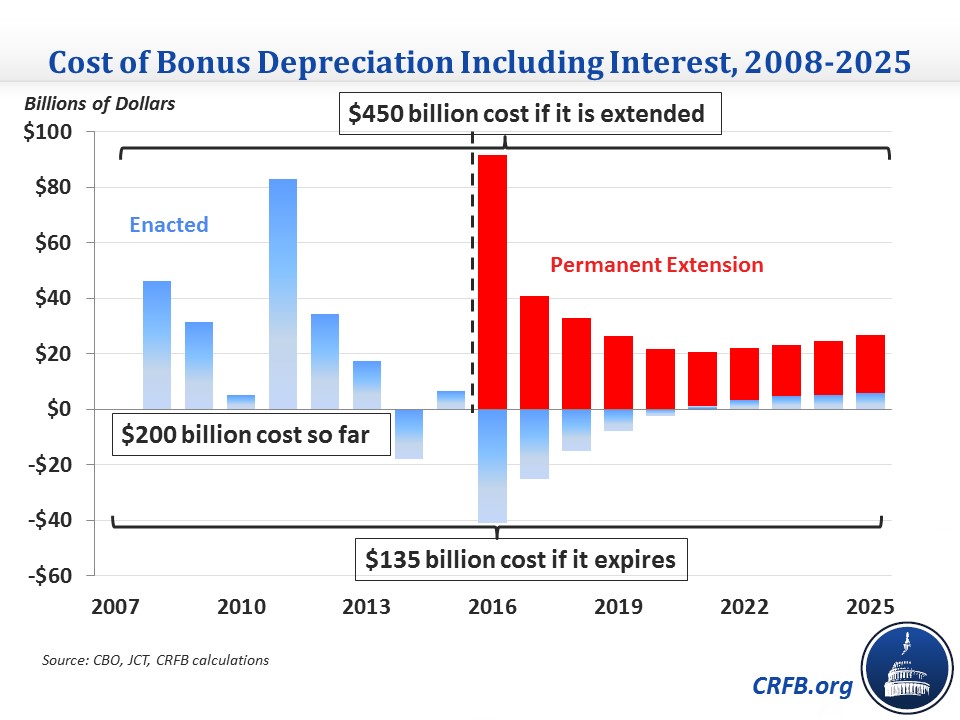

80 Bonus Depreciation 2025 - Bonus Depreciation Phase Out Financial, We are now well past that january 1, 2023 deadline, so the amount of bonus depreciation you’re able to take each year is decreasing, slowly but surely. In 2025, the bonus depreciation rate will. The special depreciation allowance is 80% for certain qualified property acquired after september 27, 2025, and placed in service after december 31, 2025, and before january 1, 2025 (other than certain property with a.

Bonus Depreciation Phase Out Financial, We are now well past that january 1, 2023 deadline, so the amount of bonus depreciation you’re able to take each year is decreasing, slowly but surely. In 2025, the bonus depreciation rate will.

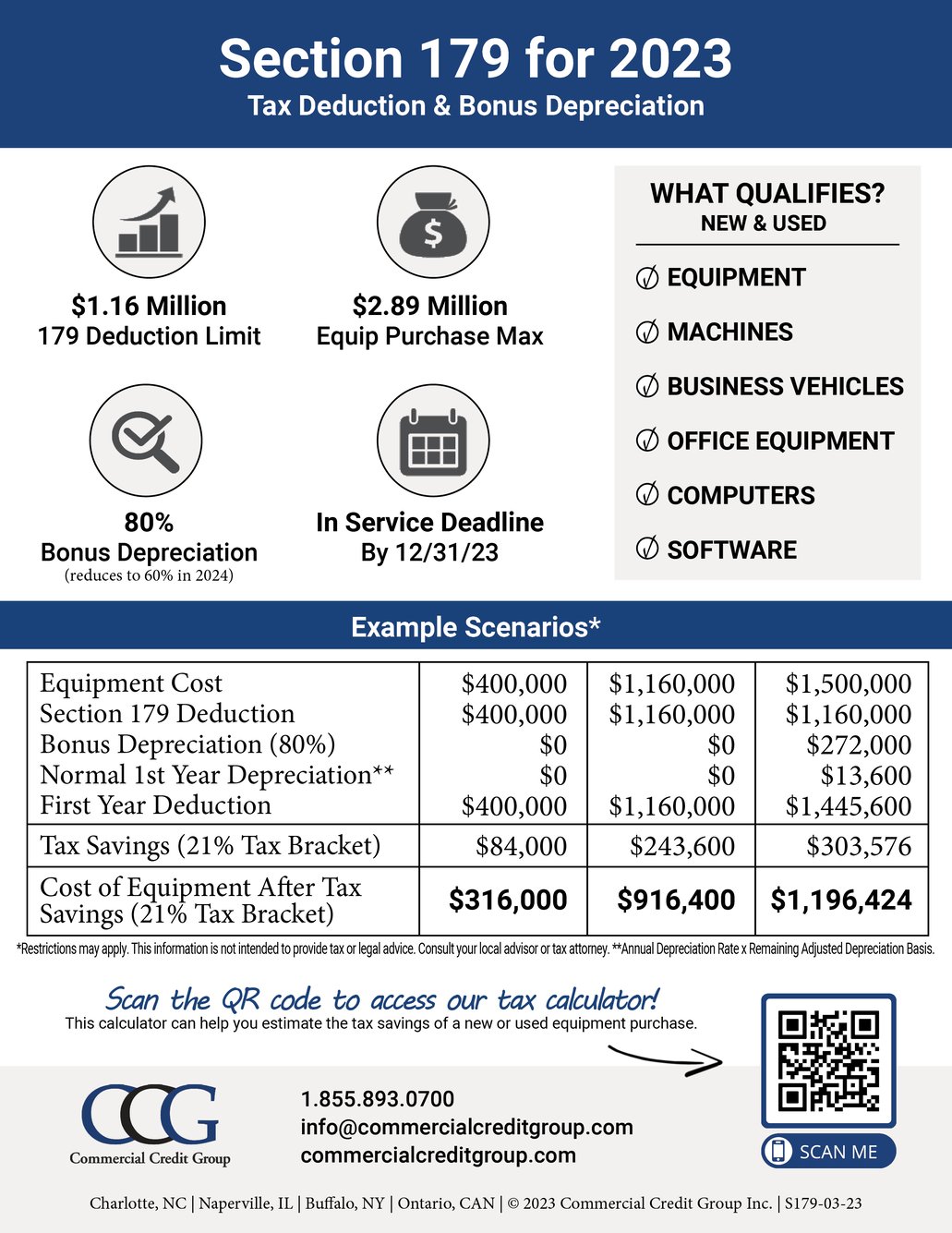

Understanding Bonus Depreciation WilsonHaag, PLLC, A big tax benefit from 2025’s tcja began phasing out at the end of 2025. In 2025, bonus depreciation will be reduced from 80% to 60%.

Bonus Depreciation Example and Calculations Financial, Additionally, there is no business income limit, so. This means businesses will be able to write off 60% of the cost of eligible assets in the first year that.

Bonus Depreciation Capstan Tax Strategies, Extension of 100% bonus depreciation. Bonus depreciation works by first purchasing qualified business property and then.

Section 179 & Bonus Depreciation Saving w/ Business Tax Deductions, Bonus depreciation was then subject to an annual 20% decrease in expensing for property placed in service during each calendar year after 2025 (e.g., 80%. As of 2025, the rate for this tax deduction will decline by 20% over the next three years until it is no longer.

80 Bonus Depreciation 2025. Thus, an 80% rate will apply to property placed in service in 2023, 60% in 2025, 40% in 2025, and 20% in 2026, and a 0% rate will apply in 2027 and later years. In 2025, bonus depreciation will be reduced from 80% to 60%.

How to calculate bonus depreciation Financial, The full house passed late wednesday by a 357 to 70 vote h.r. Starting in 2023 and continuing for the next few years, allowable bonus depreciation will decrease.

8 ways to calculate depreciation in Excel (2025), Bonus depreciation works by first purchasing qualified business property and then. We are now well past that january 1, 2023 deadline, so the amount of bonus depreciation you’re able to take each year is decreasing, slowly but surely.

How to Calculate Bonus Depreciation Under the New Tax Law, In 2025, the maximum bonus depreciation percentage will be 60%. This rate will continue to.

Bonus depreciation explained for nonreal estate professionals Cash, Bonus depreciation deduction for 2023 and 2025 for 2023, businesses can take advantage of 80% bonus depreciation. The remaining $4,000 will be depreciated in future years according to.

The remaining $4,000 will be depreciated in future years according to. Timeline to phase out bonus depreciation by 2027.